How does an RESP or Registered Education Savings Plan work?

An RESP or Registered Education Savings Plan (RESP) is an investment program that lets you set money aside and let it grow, tax-free, until your child begins post-secondary studies.

There are two types of RESPs: individual and family.

There is the individual RESP, which involves a single beneficiary and a subscriber who may or may not be related to the beneficiary. For the individual plan, there is no maximum age for the beneficiary.

The other option is the Family RESP, for which one or more beneficiaries may be named, but the subscriber must be related to the beneficiaries by blood or adoption. For the Family RESP, the beneficiary or beneficiaries must be under 31 years of age. The Registered Education Savings Plan (RESP) must be terminated before December 31 of the 35th year following the plan’s inception.

Note that the maximum lifetime contribution per beneficiary is $50,000 for the duration of the plan. There is no annual maximum.

RESPs and government grants

The popularity of RESPs stems mainly from the fact that they offer substantial and attractive government grants.

Your child, or any other person you name as a beneficiary of the plan and who is 17 years of age or under, can initially receive the basic Canada Education Savings Grant (CESG). This grant is equal to 20% of the annual contribution on the first $2,500 paid each year, up to a lifetime maximum grant per beneficiary of $7,200.

However, in 2007, the Quebec government created the Quebec Education Savings Incentive (QESI). The criteria are the same as those outlined above. The provincial grant in this case is 10% of the annual contribution on the first $2,500 paid each year, up to a cumulative maximum lifetime grant per beneficiary of $3,600.

Withdrawal of EAPs: Educational Assistance Payments

Educational Assistance Payments (EAP) refer to income generated by the RESP, including grants when the beneficiary is a student.

To discuss the best strategy for your RESP, talk to one of our experts. CTA Contact us.

Difference between contributions and accumulated income, which includes the subsidy.

By education assistance payments (EAP), we refer to the income generated from the RESP, including grants when the beneficiary is in school.

To discuss the best strategy for your RESP, speak with one of our experts. CTA Contact Us.

RRESP: Full-time student

To qualify, the student must be enrolled full-time or part-time in an eligible training program.

In general, the maximum payment is $5,000 for the first 13 weeks the beneficiary is a full-time student. Once these 13 weeks have been completed, there is no limit to the amount of EAPs, provided the student is still eligible. If, during a 12-month period, the student does not participate in a qualifying training program for 13 consecutive weeks, the $5,000 limit applies again.

RRESP : Part-time student

For a part-time student, the maximum payment for the first 13 weeks is $2,500.

Although Human Resources Canada does not specify a limit on EAPs, in fact, since 2008, the CRA has set a limit on the amount of EAPs that can be withdrawn annually. The responsibility lies with plan sponsors. For example, in 2017, this limit was set at $23,113 and is indexed annually.

It is the subscriber who must request the withdrawal and specify whether it is to be made from contributions or from accumulated income. If it comes from accumulated income, the payment must be made to the student. This is referred to as an Educational Assistance Payment (EAP) and is taxable to the student. Contributions, on the other hand, can be withdrawn without limit and tax-free, and are returned to the subscriber.

RESPs: What happens if my child doesn’t go to school?

In the first instance, grants will have to be returned to governments. As for your capital, i.e. your contributions, they are payable to you and are non-taxable.

However, you have the option of transferring the income generated on your capital and the grant to your RRSP, up to a maximum of $50,000. To do so, you must be the original subscriber, or his or her spouse if deceased.

If there is another subscriber following the death of the original subscriber and there is no spouse, the transfer is not applicable. Of course, you must have unused RRSP contribution room. You can also contribute to your spouse’s RRSP.

Alternatively, you could consider making a donation. There is no penalty and the donation is tax-free if it is made to a Canadian designated educational institution.

However, there is no donation tax credit in this case.

If you are not considering a gift and have no RRSP room available, the payment is taxable to the recipient, and an additional tax on top of your own tax rate applies. The federal rate is 20% (except in Quebec: 12%) and the Quebec rate is 8%.

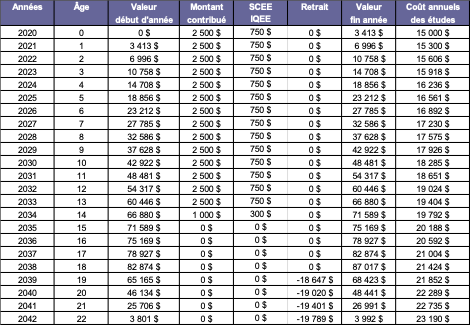

Here’s an example of how an RESP can help pay for post-secondary education.

When the time comes, your child will be able to concentrate on his or her studies without having to worry about finding the money to pay for them.

Assumptions

- Estimated annual cost of education: $15,000 (student covers the cost of housing, food, etc.)

- Withdrawal over 4 years starting at age 19

- Rate of return: 5%

- Inflation: 2%

Results

-

-

- Total contributed: $36,000

- Value at 18 years old: $87,017

-

To learn more about how RESPs work, get in touch with one of our experts.

The comments contained in this article are a general discussion of certain issues, provided for informational purposes only, and should not be considered as tax or legal advice. Please seek independent professional advice in the context of your particular situation. This article was written, designed, and produced by [advisor’s name], Mutual Fund Representative with Investia Financial Services Inc. and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article is sourced from what we believe to be reliable sources, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation as of the publication date and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell securities.

Investments in mutual funds, exempt market products, and exchange-traded funds may be subject to commissions, trailing commissions, management fees, and other expenses. Please read the fund overview or prospectus carefully before making an investment. Investments in mutual funds, exempt market products, and exchange-traded funds are not guaranteed, their values often fluctuate, and past performance is not indicative of future returns.